Understanding the Importance of Quality Insurance

In trendy swiftly evolving international, coverage plays a pivotal role in shielding our financial balance, fitness, property, and even our loved ones. The link https://noticviralweb.Blogspot.Com/2024/05/mejores-seguros.Html offers an insightful review of the satisfactory coverage alternatives to be had in 2024, making it a valuable resource for people and families looking for reliable protection. With rising dwelling expenses, multiplied health risks, and unpredictable international events, it’s no longer a luxurious but a need to have a comprehensive coverage coverage. From existence to home, auto to travel, choosing the proper insurance guarantees peace of mind and financial resilience during difficult instances. Insurance doesn’t just steady belongings; it safeguards futures, presenting lengthy-term safety in a international full of uncertainties.

Types of Insurance You Must Know

Life, Health, Auto, and Property Coverage

Navigating the great international of insurance starts offevolved with know-how its numerous forms. As highlighted in https://noticviralweb.Blogspot.Com/2024/05/mejores-seguros.Html, the maximum vital kinds encompass life, fitness, vehicle, and property insurance. Life insurance gives economic assist on your dependents within the occasion of your untimely death, ensuring their well-being and destiny wishes. Health coverage affords coverage for medical fees, surgical procedures, and every now and then even intellectual fitness assist. Auto coverage protects towards car damage, theft, and liabilities in injuries, making it crucial for drivers. Lastly, assets insurance safeguards your house or commercial enterprise from herbal failures, theft, or accidental damage. Each type serves a completely unique purpose, however together, they form a entire safety internet for your lifestyles and belongings.

Benefits of Choosing the Right Insurance

Long-Term Protection and Peace of Mind

The advantages of selecting the proper coverage move beyond simple threat coverage. At https://noticviralweb.Blogspot.Com/2024/05/mejores-seguros.Html, you’ll discover comparisons and critiques that assist identify policies supplying now not simply primary protection however also comprehensive guide tailor-made to your desires.

A right coverage will provide short declare settlements, sizable insurance options, cheap premiums, and first-rate customer support. More importantly, it guarantees which you and your loved ones aren’t financially careworn in times of disaster. Whether it’s paying health facility payments, convalescing from a car twist of fate, or rebuilding a broken home, the proper coverage company stands by using you thru every challenge. This sense of security is precious in modern day unsure global.

How to Compare Insurance Policies

Factors to Evaluate Before Buying

Making the proper choice in coverage starts with thorough evaluation. According to https://noticviralweb.Blogspot.Com/2024/05/mejores-seguros.Html, it’s vital to evaluate rules based on insurance limits, deductibles, exclusions, top rate rates, claim system performance, and purchaser critiques. Some guidelines may additionally offer decrease premiums but have confined insurance, at the same time as others might be comprehensive however steeply-priced. It’s crucial to locate the right stability. Additionally, be aware of accessories or riders which can enhance your safety at a minimal extra price. Use assessment equipment or insurance aggregators to get aspect-with the aid of-facet policy breakdowns, that can make the choice manner simpler and extra effective. Doing your homework in advance guarantees you don’t face disappointments throughout claim instances.

Best Insurance Companies in 2024

Reliable Providers You Can Trust

One of the key capabilities of https://noticviralweb.Blogspot.Com/2024/05/mejores-seguros.Html is its curated list of top coverage businesses for 2024. These carriers had been evaluated based totally on their monetary balance, marketplace popularity, policy diversity, and patron delight. Companies like Allianz, AXA, Liberty Mutual, and Mapfre retain to dominate because of their consistency, innovation, and extensive-ranging insurance options. These companies also offer virtual platforms, 24/7 help, and seamless online claim processing, aligning with the needs of current clients. Whether you’re insuring a family or a enterprise, partnering with a reputed insurer reduces the dangers of claim denials, delays, or hidden expenses, making your funding worthwhile.

Common Mistakes to Avoid When Buying Insurance

Save Money and Avoid Pitfalls

Many humans rush into shopping for insurance without proper information, often leading to regret and losses later. Based on suggestions from https://noticviralweb.Blogspot.Com/2024/05/mejores-seguros.Html, key mistakes include underinsuring, ignoring exclusions, skipping the exceptional print, not evaluating plans, and trusting unauthorized agents. It’s essential to study policy files thoroughly, ask questions, and seek advice from experts if wanted. Always expose correct records approximately your fitness, property, or assets to keep away from declare rejection. Avoid selecting the most inexpensive plan blindly, as it may not provide adequate coverage whilst it subjects maximum. Learning from others’ errors can guide you in the direction of smarter choices and greater steady coverage investments.

Digital Tools for Insurance Management

Manage Your Policy Online with Ease

The insurance industry is increasingly going digital, and this shift is making it simpler for policyholders to get right of entry to, manipulate, and track their coverage. According to insights from https://noticviralweb.Blogspot.Com/2024/05/mejores-seguros.Html, cutting-edge insurers now provide cell apps, online dashboards, AI-powered chat guide, and instant policy issuance.

You pays rates, record claims, download files, and even update your insurance info in only a few clicks. This virtual transformation not most effective complements consumer revel in but also improves transparency and decreases paperwork. Embracing these gear guarantees you are constantly in control of your coverage, no matter in which you are or what time it is.

How to Save Money on Insurance

Budget-Friendly Insurance Hacks

Insurance doesn’t should be high priced in case you realize the right ways to cut costs. Https://noticviralweb.Blogspot.Com/2024/05/mejores-seguros.Html famous numerous strategies to make guidelines greater affordable. Bundling a couple of rules with the same provider often results in reductions. Opting for a higher deductible can reduce charges, even though it will increase your out-of-pocket expense at some point of claims. Maintaining an awesome credit score rating and secure driving file also enables in lowering charges. Additionally, yearly reviewing your policy and getting rid of pointless add-ons can optimize your coverage with out overspending. Always ask your insurer for available discounts—they will offer loyalty, no-declare, or early chicken benefits that appreciably reduce your economic burden.

The Future of Insurance Trends

What to Expect in the Coming Years

The landscape of insurance is evolving, and https://noticviralweb.Blogspot.Com/2024/05/mejores-seguros.Html highlights numerous interesting traits. Usage-based insurance (UBI), AI-powered underwriting, customized coverage, and embedded coverage are shaping the destiny of the enterprise. Insurers are an increasing number of counting on data and analytics to tailor policies to character desires and lifestyles. Climate alternate is likewise prompting agencies to increase greater resilient and inclusive insurance plans. The emphasis is moving from reactive to proactive safety, where generation predicts risks and stops losses. This method the coverage of the next day will now not only cowl you after an incident but would possibly help avoid the incident altogether thru smarter answers.

Making the Final Decision

Choose Wisely and Stay Protected

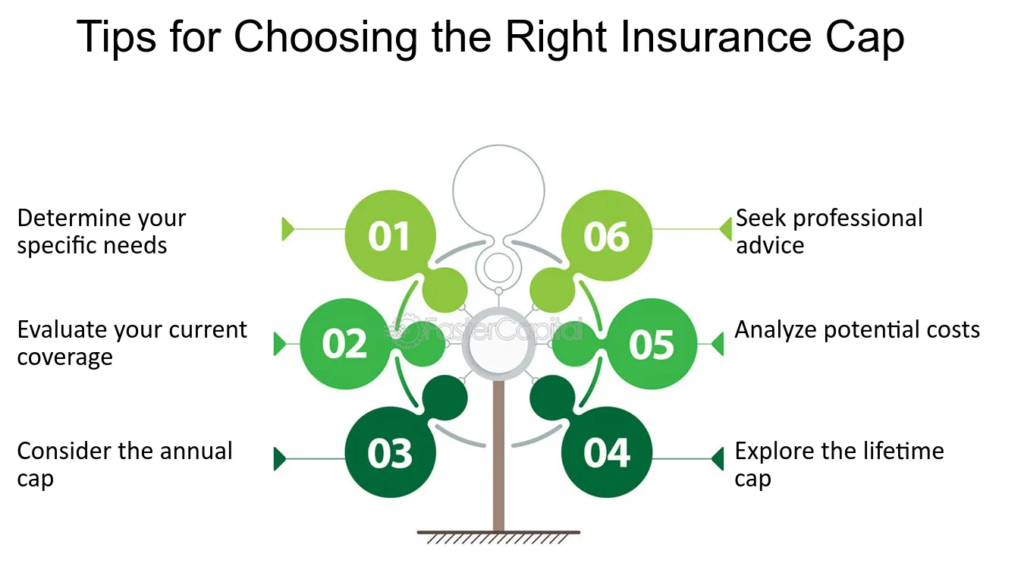

Choosing an coverage coverage is a decision that needs cautious concept and ongoing management. As shown in https://noticviralweb.Blogspot.Com/2024/05/mejores-seguros.Html, understanding is your exceptional ally in navigating this complex panorama. Evaluate your unique desires, do in-depth comparisons, and are searching for assist from certified marketers while doubtful. Consider your lifestyles level, earnings, health, and family needs before finalizing any plan. Review your coverage annually to make certain it evolves with your changing situations. Insurance isn’t always only a purchase—it’s a lifelong commitment on your safety and that of your family. Making the right decision nowadays ought to suggest stability and self belief for future years.

Bullet Points: Key Takeaways

Compare rules primarily based on advantages, charges, and customer support.

Avoid common errors like underinsurance or ignoring quality print.

Use virtual gear to simplify insurance control.

Bundle regulations and maintain a very good credit score rating to store cash.

Follow destiny coverage trends for smarter coverage.

Conclusion: Insurance is Your Smartest Investment

In a global packed with unpredictability, having the proper coverage isn’t just smart—it’s important. From protecting your loved ones to protective your belongings and income, coverage acts as a protection internet that gives you freedom to stay boldly and dream larger. The resource https://noticviralweb.Blogspot.Com/2024/05/mejores-seguros.Html serves as an superb guide for all of us seeking to invest inside the exceptional coverage options in 2024 and past. Remember, the true fee of insurance lies now not simply in coverage however in self assurance. Make informed alternatives today, and secure a brighter, worry-unfastened the following day.

FAQs About https://noticviralweb.Blogspot.Com/2024/05/mejores-seguros.Html

1. What varieties of coverage are discussed at the page?

The website discusses existence, health, vehicle, assets, and journey insurance alternatives with a focal point at the high-quality available plans in 2024.

2. Can I find policy comparisons at the blog page?

Yes, the blog presents comparisons, critiques, and hints to assist users pick the most suitable coverage coverage.

3. Are the coverage agencies listed dependable?

The weblog highlights reputed agencies known for notable customer service, comprehensive coverage, and economic reliability.

4. How can I save cash the usage of hints from the blog?

It offers strategies like bundling guidelines, deciding on better deductibles, and utilising discounts to lower your charges.

5. Is the records updated for 2024?

Absolutely. The page is regularly up to date to mirror contemporary traits, pinnacle coverage companies, and marketplace adjustments for 2024 and beyond.

Also Read This: Understanding the Core Concept of Vietc69